Zoho Books with GST Course

Cloud-based accounting and GST compliance training for modern businesses

The Zoho Books with GST course at AuroSkill is designed for learners who want hands-on experience in cloud-based accounting, invoicing, reconciliation, and GST compliance using Zoho Books. This course focuses on how startups, SMEs, and digital-first businesses manage their accounting and GST workflows today. Training is practical, classroom-based, and aligned to real-world accounting roles.

Who This Course Is For

- Graduates and college students

- Aspiring accountants working with startups and SMEs

- Accounting professionals transitioning to cloud-based tools

- CA Foundation or CA Inter students exploring alternate paths

- Commerce and non-commerce background learners seeking practical accounting exposure

What You Will Learn

- Fundamentals and company set up

- Accounting transactions and Voucher entry

- Purchase and sale invoice

- GST Fundamentals – Concept, Purpose & Structure

- Core GST Concepts & Tax Structure

- Composition Scheme & Registration Compliance

- Supply, Place of Supply & Time of Supply

- Input Tax Credit (ITC) Management

- GST Returns, Refunds & Audit

- E-Way Bills, E-Invoicing & Practical Compliance

How This Course Helps Your Career

This course prepares you for roles such as:

- Accounts Executive (SME / Startup)

- Junior Accountant

- Billing & GST Executive

- Accounting support roles in growing businesses

Course Format

- Classroom-based training

- Hands-on practice using live Zoho Books workflows

- Focus on startup and SME accounting use-cases

- Short-duration module (details shared during counselling)

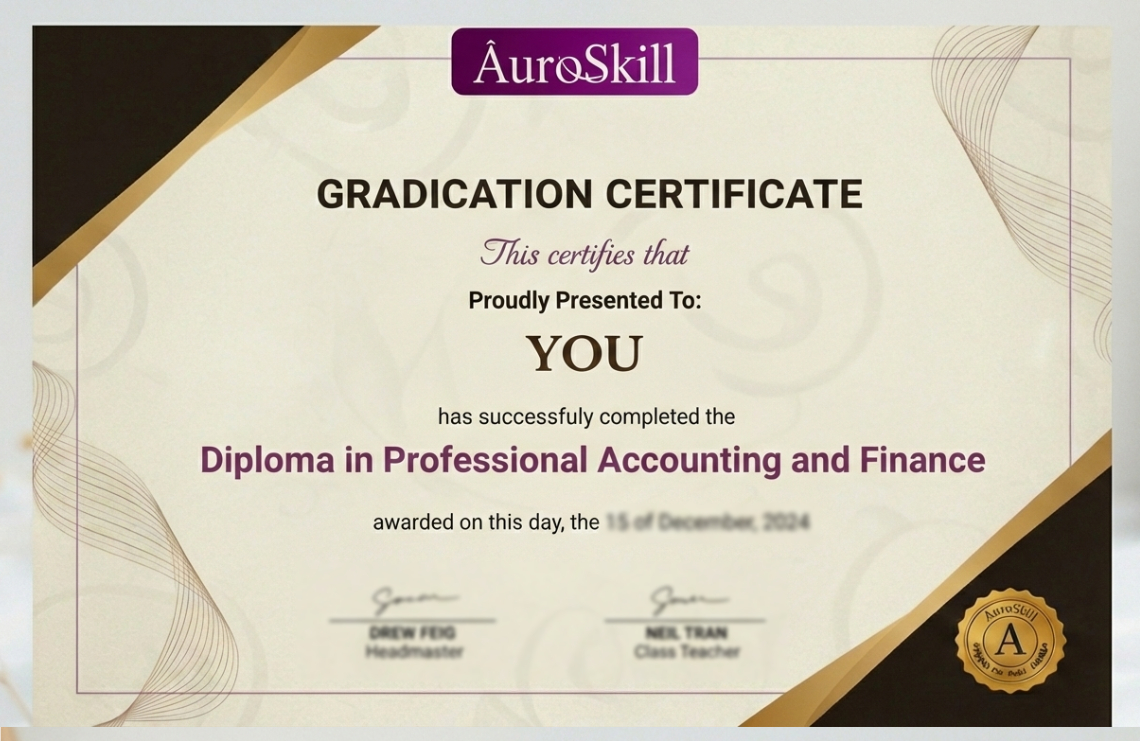

Dual Certification

For Your Career

Students who successfully complete the Diploma Program receive Dual Certificates:

- The AuroSkill Certificate of Completion recognising your job readiness.

- A Certification from Indian Institute of Skill Development Training (IISDT).

These certificates validate your practical training and demonstrate your preparedness for real accounting and finance roles to potential employers.